Irs 2025 Schedule 1 - Skip to main content skip to primary sidebar See current federal tax brackets and rates based on your income and filing status. Irs.gov Form 1040 Schedule B at viiarmandoblog Blog, The 2025 hsa contribution limit for.

Skip to main content skip to primary sidebar See current federal tax brackets and rates based on your income and filing status.

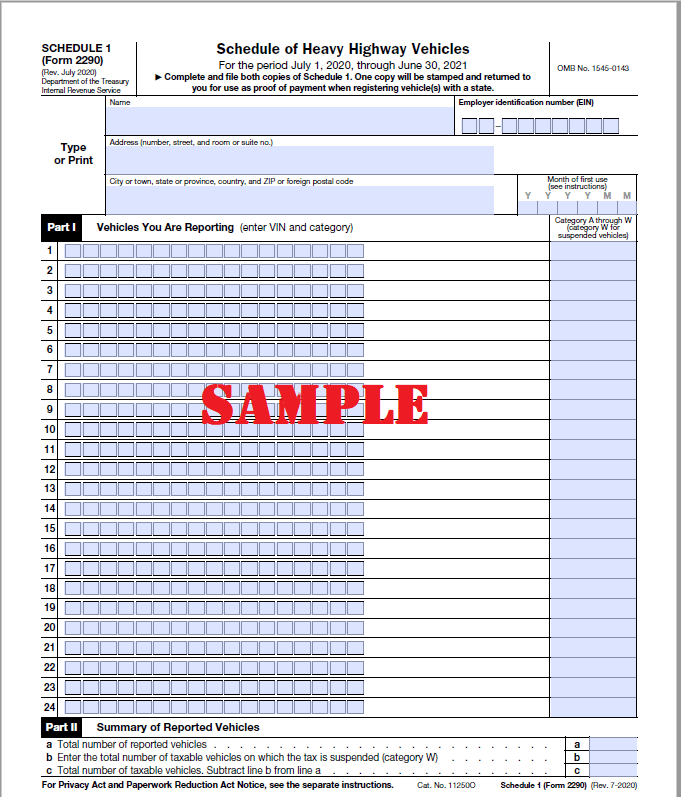

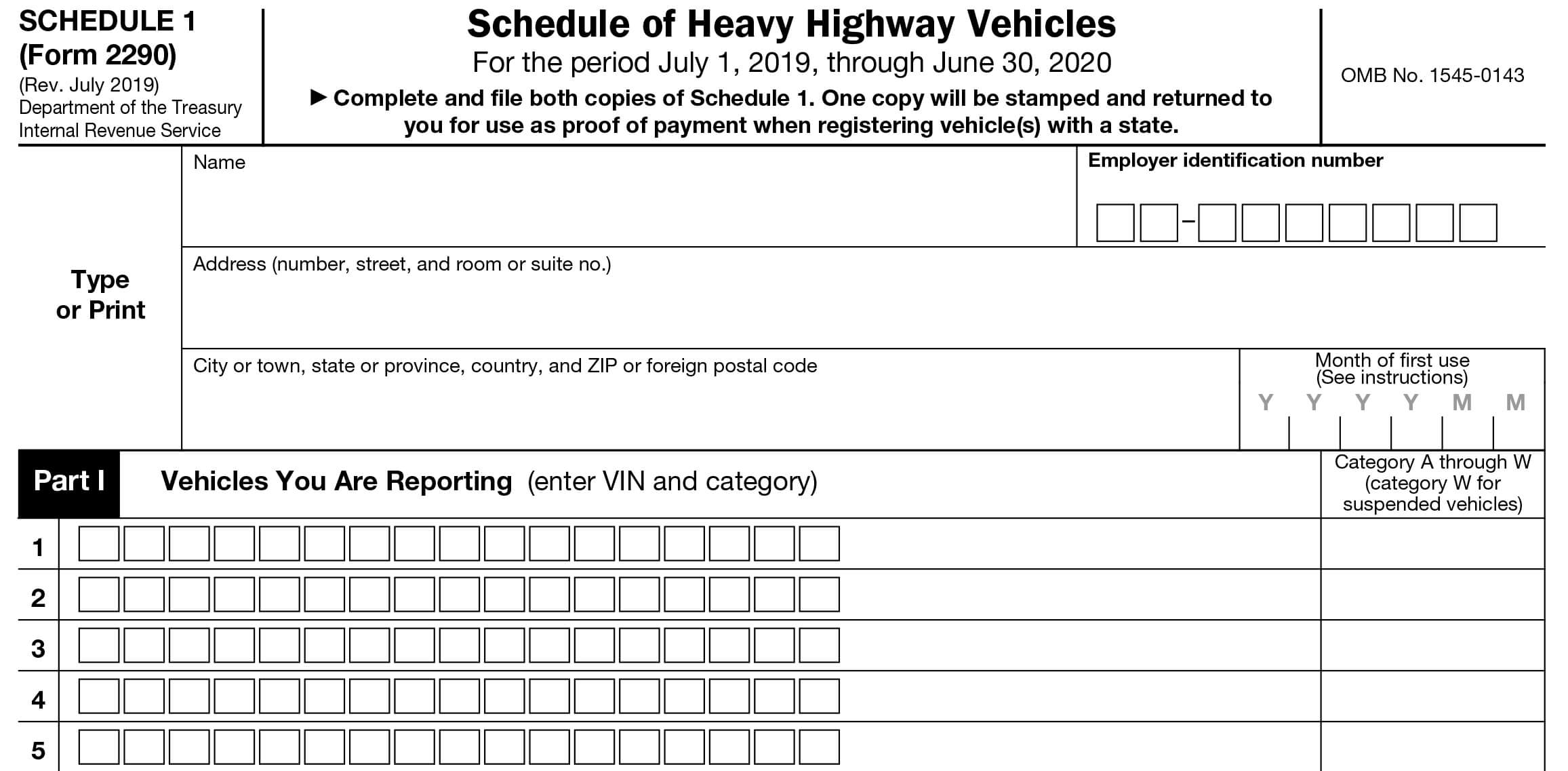

Irs Tax Filing 2025 Rahal Claresta, Form 2290 filers must enter the month of first use in schedule 1 to indicate when the vehicles included in schedule 1 were first.

Florida Tax Free 2025 Schedule 1 Molly Lewis, Form 2290 filers must enter the month of first use in schedule 1 to indicate when the vehicles included in schedule 1 were first.

When Are Quarterly Taxes Due 2025 Irs Keith Turner, Single filers who earn between $48,350 and $533,400 will.

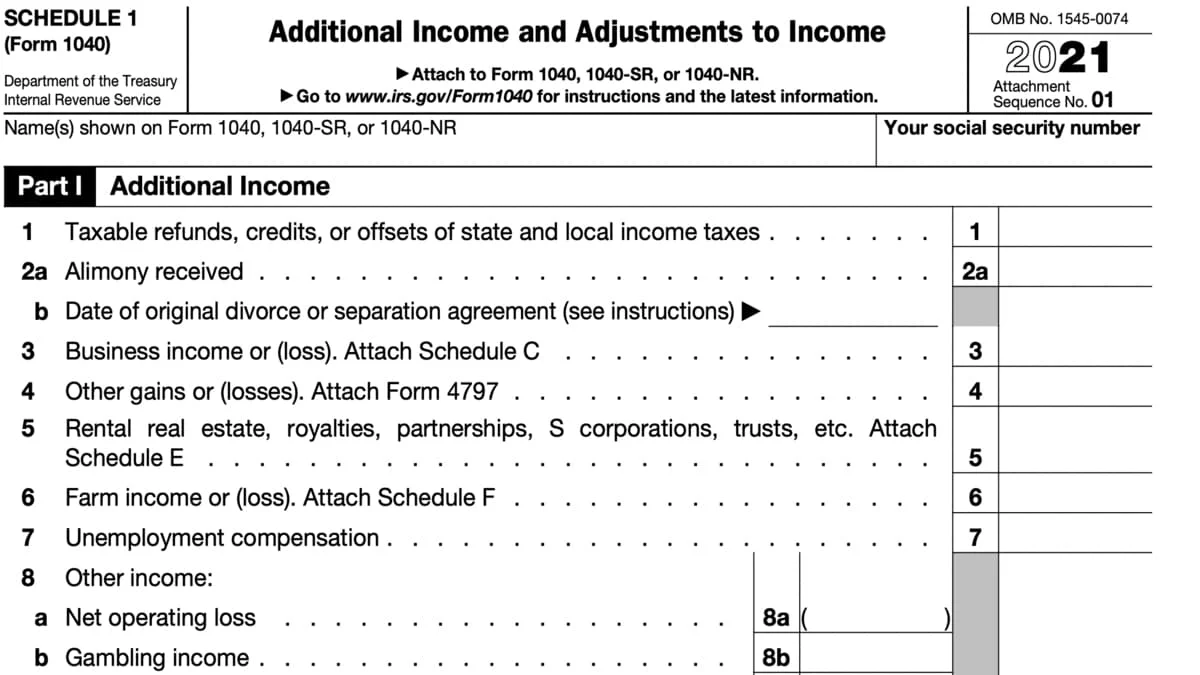

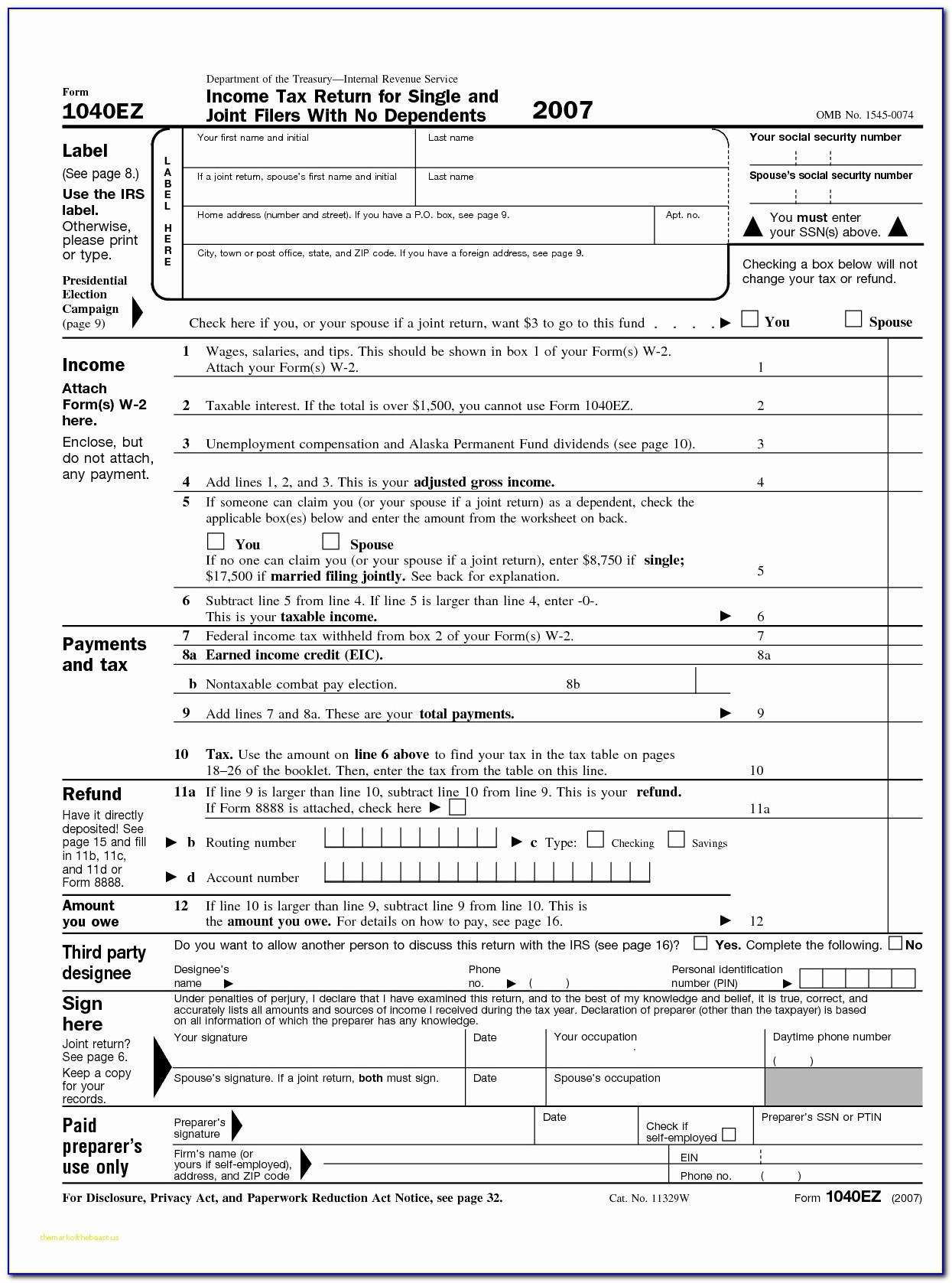

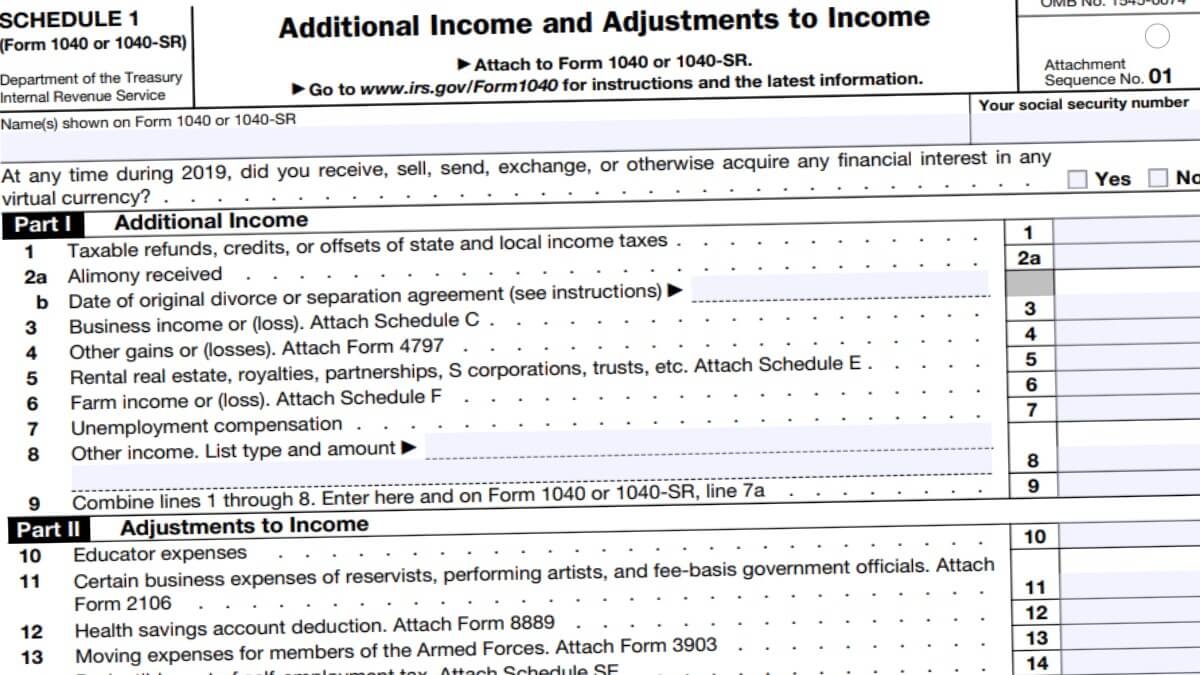

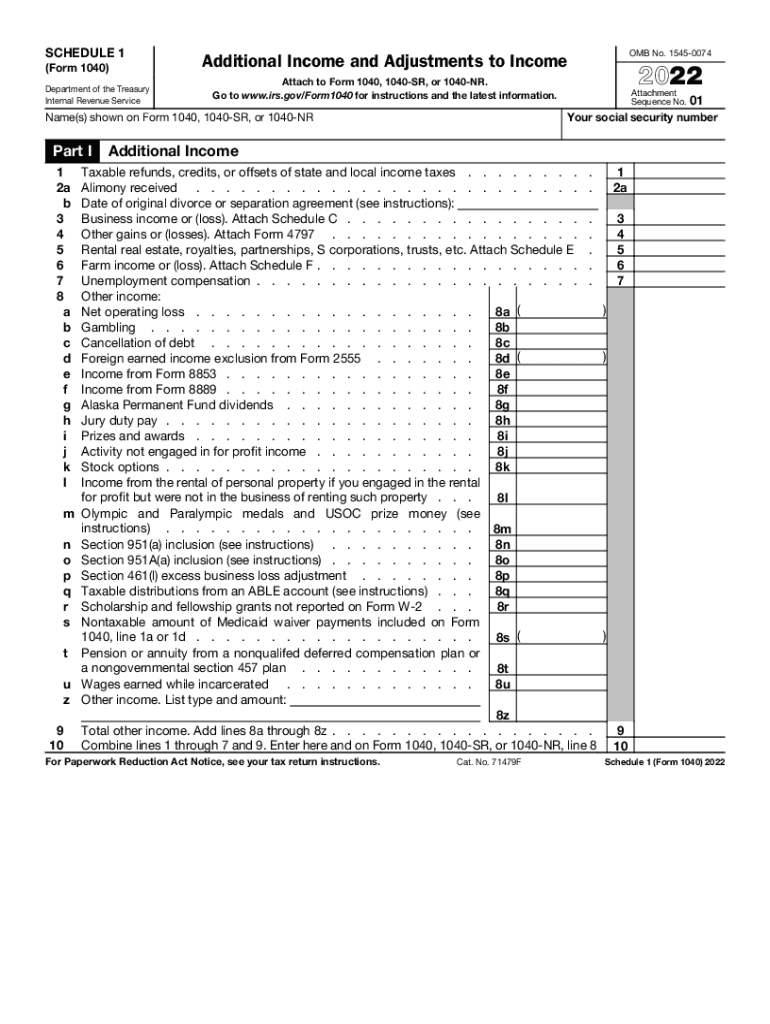

2025 Irs Form 1040 Schedule 1 Instructions Pdf nessy rebecca, Schedule 1 is now essential for reporting specific types of income and deductions known as adjustments.

Irs 2025 Schedule 1 Rikki Kirsteni, The limit is $4,300 if you are single.

Irs Tax Refund Schedule 2025 Ashli Camilla, The limit is $4,300 if you are single.

Are Home Office Expenses Deductible In 2025. As an employee,…

2025 Schedule 1 Form 1040 Ivonne Oralla, The irs announced a nice increase to the maximum health savings account contributions for 2025.

Unl Academic Calendar Fall 2025. Additionally, these dates are subject…

Irs 2025 Schedule 1. Your bracket depends on your taxable income and filing status. First, determine your expected adjusted gross income (agi), taxable income, taxes, deductions, and credits for.